Weekly Articles

PURSUING YOUR FINANCIAL GOALS WITH EXPERIENCED GUIDANCE

ADV Quick Note On Metals

Mike Savage

Quick Note on Metals …

There may be some short-term negative volatility in gold and silver. My take is that it is likely to last through this week. The reason is that China has been a main driver in the rising prices. They have also been instrumental in moving the pricing of metals out of the paper casinos and into the physical assets themselves- obviously- a far more fair way of valuation.

China is celebrating their Lunar New Year this week, and this will allow those that manipulate paper prices to move the price- almost always down- without the physical demand that has been thwarting their manipulative tactics in recent history.

I would not let fear creep in here. This is a short-term maneuver that will shake out weak hands and make them miss out on what I believe will be FAR higher prices in the coming months.

Remember- Price is what you pay- VALUE is what you get. Anyone who may be looking to establish a position or add to a position- this week may present an opportunity that may not present itself again at these prices.

Hang in there and …

Be Prepared!

Any opinions are those of Mike Savage and not necessarily of those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The information in this report does not purport to be a complete description of securities, markets or developments referred to in this material. The information has been obtained from sources deemed to be reliable but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

moreWeekly Article 02/12/2026 - ADV Inequality

Mike Savage

As I am writing this, the DJIA is sitting at just above 50,000. The S&P is sitting just shy of 7000 and the Nasdaq is a little over 25,000. Real Estate, while showing signs of a serious repricing soon, is also at or near all-time highs in most places.

While those who own these assets are basking in the glory of rising prices those who do not hold these assets are getting crushed. The barrier to entry into most of these “markets” is being constantly ratcheted up. This rewards those with assets and punishes those trying to gain access to those assets.

We often hear about income inequality. Right now, income inequality is at an all-time record. According to USDebtclock.org, the top 1% of households have an average net worth of over $20 million. The bottom 50% of households have a NEGATIVE net worth of MINUS 35,372. A lot of the negative net worth is caused by debts for cars, homes, student loan debt, credit card debt, etc. With all of this outstanding debt (Pledge of future earnings) saving and investing becomes harder and harder as prices rise.

It is extremely telling when ½ of our population has more liabilities than assets.

moreWeekly Article 02/06/2026 - Rented Wealth?

Mike Savage

What is it that they know that they hope you don’t know? Remember, I always say watch what they do-not what they say.

I am talking about those “in charge” and their buddies at the major banks, governments, and hedge funds.

I believe that what they know is that all assets (notice I didn’t say promises to repay) derive VALUE from PHYSICAL goods.

JP Morgan himself famously said “Gold is money- all else is credit” (Another’s promise to repay) as he was bailing out the United States. All the wars we see around the world- is it any surprise that there are few, if any wars where there are no oil, critical minerals or assets that provide primary wealth?

Primary wealth is primarily natural resources. Those things needed to produce the sustenance that we all need like water, farmland, oil, gas, fishing grounds, etc.

Without these inputs secondary wealth could not be created. Secondary wealth is the wealth created by transforming natural resources into food, lumber, gas, and necessities of life.

For centuries, Europe in particular has been pillaging the world- Africa is the most noticeable by paying below market prices for their national assets and creating secondary wealth- like jewelry, nuclear power, and a myriad of other things that have kept parts of Africa in abject poverty while those who manipulate prices get wildly rich.

moreWeekly Article 01/30/2026 - ADV Spinning Plates

Mike Savage

Many who are reading this may not remember watching the old variety shows that were on when I was a kid. One of the things I remember was an act that had long poles and they would attempt to keep a number of plates circulating on top all at once. As the number of plates grew it became more obvious that it was going to be difficult if not impossible to add any more plates as many were wobbling and had to be dealt with or they would come crashing down.

This reminds me of the “act” the Fed and many other central banks are taking. It appears that every time we turn around another (manipulated) plate is wobbling. It also appears that if there was a lapse in keeping control, (“printing, buying and manipulating”) many plates could come crashing down at the same time.

Just looking at the most obvious it appears that most, if not all fiat currencies are being questioned as the CURE for the last meltdown (“Printing, buying and manipulating”) has now become the DISEASE. Why? Because they have gone too far and the expense of carrying the massive amounts of debt issued are crushing the economy. In addition, since they are “printing up” cash from nowhere to even pay interest it is leading to a huge loss in purchasing power. This has led to what could be described as a Franken market. (Basically a “market” being kept propped up with cheap money and financial games rather than solid fundamentals and earnings). A “market” that has NO relation to the underlying economic engine.

moreWeekly Article 01/23/2026 - ADV My Take On Gold and Silver Now

Mike Savage

We have seen massive gains in precious metals and the companies that mine those metals. Many are asking “Did I miss it?” and what can we expect going forward.

While I have spent most of the last 15 years following this space, I have learned over that time that whatever you might expect- be ready for surprises.

In the past, most of the surprises came to the downside. I attribute this to the fact that the major banks and the Fed were manipulating the price of gold in particular down to keep the illusion of “strong US dollar” alive. This worked for an extended period of time as paper trading made it appear that there was FAR more supply than actually existed and sales of PAPER at the most inopportune times (times when there is little participation) to ensure that the desired outcome was achieved.

In most cases, an INVESTOR would want to sell to get the best price- when most traders would be there to buy. One of the first clues I had that this was a total fraud was the fact that the beatdowns always took place in the middle of the night to have maximum downside leverage. How many of US would trade to get a LOWER price?

Other central banks were probably also in on the scheme- particularly European banks. This also allowed those “in charge” to get the asset at a DEEP discount- basically cheating the PRODUCERS out of what would likely be a FAR higher price.

moreWeekly Article 01/16/2026 - ADV Inflation or Deflation?

Mike Savage

Inflation, deflation-or both?

Many smart people have differing opinions on whether we will experience inflation or deflation going forward. Those who expect deflation look at a collapsing economy and rightly propose that weaker demand will cause lower prices.

Those who expect inflation will propose that the Fed, Treasury and President will do all they can to prop up the economy and asset prices. This is already taking place as the Fed is buying $40 BILLION per month in Treasuries, the Treasury is already planning to buy mortgage- backed securities that are rolling off the Fed’s books (with “money” borrowed from the Fed and conjured up from nowhere) and the president will be appointing a new Fed president in May. Many are speculating he will be doing the president’s bidding. The President has made no bones about wanting lower rates and a weaker dollar. This will take trillions of dollars that don’t currently exist to pull off.

As usual, this “money” which costs virtually NOTHING to conjure up and produces NOTHING leads to “too much money chasing too few goods- or the perfect recipe for higher prices- for almost everything.

While I am in the camp of INFLATION because throughout history, we have seen that when faced with the situation we are in now, those “in charge” have always taken the easy way out and “printed” their currency into oblivion.

moreWeekly Article 01/08/2026 - ADV 2026

Mike Savage

As 2026 begins there is no shortage of headlines that lead me to believe that inflation is going to be a MAJOR problem going forward.

While a lot of hot air is being spent on telling us that things are “GREAT!” the reality on the ground is anything but great. The spin created that inflation has been defeated will likely be blown out of the water during this year of 2026. There are many reasons for my beliefs in this including:

· The Fed admitting that they are “printing up” $40 Billion per month to fund our government because our traditional buyers are becoming sellers and there is not enough demand for the amount of debt we are adding DAILY. The prior buyers have seen the US dollar weaponized. They see a country which is the largest debtor in the history of the world and appears to have NO PLAN to even stop the bleeding let alone to pay down even a portion of the record debts. Looking into the future, many now see that there are only two ways out. Stop adding to the debt and watch a massive collapse or keep “printing” and kick the can further while destroying the purchasing power of the dollar that you will be paid back with in the future.

· The president, US Treasury and Fed all want lower rates. This, in addition to purchasing $40 Billion per month, will have to conjure up possibly TRILLIONS of dollars to manage the interest rates. It is not only that buyers have become sellers but also that, as inflation increases, the interventions in the bond “markets” will also likely have to increase substantially to continue the ILLUSION of stability and solvency. It IS an illusion because without the “money” conjured up out of nowhere that produces NOTHING the illusion would be laid bare.

moreWeekly Article 12/23/2025 - ADV Hard Asset Reality

Mike Savage

First of all, let me wish everyone a wonderful holiday season. Merry Christmas, Happy Hannukah and Happy New Year!

2025 was a wonderful year for those of us in the precious metals space. I believe that there is still substantial upside as we go forward. The reasons are many, but I will list a few:

· Silver is under tremendous supply constraints. In other words, there is not enough supply to meet demand. In fact, Samsung has just recently reached a deal with Mexico to reopen a silver mine, and they will take ALL OF THE PRODUCTION from the mine. China is going directly to South American mines and taking delivery bypassing the traditional intermediaries like COMEX and LBMA. This reduces their ability to manipulate the prices. This is an example of how the physical market is taking pricing power away from the paper “fake markets.”

· The world is moving away from the US dollar for MANY reasons. The main beneficiary of this is GOLD. Central banks have been buying at record amounts for the past three years. This appears to not be ending anytime soon. In addition, the western retail investors- other than those at the top- have not yet entered the gold market in any size.

moreWeekly Article 12/18/2025 - ADV Double Bubble?

Mike Savage

The BIS is warning of a rare “double bubble.” The double bubble is supposedly because gold and stock share prices are moving up in unison. Traditionally, when money is going into stocks the price of gold stagnates and when people panic the price of gold usually is the beneficiary. Thus, you have two assets that are usually uncorrelated.

Today, they are both moving up together. While the BIS is viewing this as a bubble I am viewing it from another angle. What this is saying to me is that because of all the “printing and buying” taking place not only here but globally- the message I am getting is that prices are rising because currencies are falling at an accelerating rate and the stock “markets” and gold are predicting FAR higher prices in the future.

The main difference going forward, in my opinion, is that gold always has intrinsic value and many good, solid companies offer somewhat the same. The problem with most stocks today is that the majority of companies have a lot of debt that could cause a default in the future that could result in a 100% loss with no chance of bouncing back. While stocks may help in keeping up with inflation, I believe it is imperative that the stocks being held should have strong balance sheets, be in a sector that has a bright outlook and strong earnings. At this point I also believe that any stocks being held should have a product that people have to have. With the economy struggling it is likely that many discretionary purchases will be far lower than in the recent past.

moreWeekly Article 12/12/2025 - ADV Don't Hold Your Breath

Mike Savage

Gold and silver are screaming higher. For those of us that own it, it is a wonderful thing. For everyone else the message that this may be sending is quite ominous.

Gold, in particular, rises historically in times of uncertainty or currency debasement. Right now, we appear to have both in spades. We have wars and insurrections all over the globe, we have trade wars and embargos going on everywhere and a lot of “money printing” to fund all of the mayhem.

I have said many times that they can’t stop “printing,” or the entire system could collapse immediately. Right now, it is more apparent than ever that this is true. The answers coming from all the major developed countries are eerily similar. Ramp up defense spending and, as the cost of living becomes more expensive, raise taxes and send cash to keep us from a major revolt. Keep in mind the quote from Gerald Celente “When all else fails they take you to war.” It appears we are just about at that moment.

The answers that I am hearing from our “leaders” is at best WEAK and at worst- EVIL.

Let’s take a look at the proposed 50-year mortgage. This would likely make a majority of the public debt slaves for life. The reality is that the monthly payment would likely be reduced by around 20% but the cost over time would be about 87% HIGHER. The main question here is that with that type of an albatross and rising property taxes- do you really ever OWN that home?

moreWeekly Article 12/04/2025 - ADV Negative Or Realistic?

Mike Savage

Many people have told me in the past that I am negative because I point out what I am seeing. I write this to add a bit of reality to extremely underreported news by the financial game shows and mainstream media. It is not a big shock that many would think that I am off base since they are swallowing propaganda 24/7 from those same sources. (Tell a lie often enough and it becomes the truth).

How many are aware that if you invested $10,000.00 in the year 2000 into the S&P 500 index you would have seen your $10,000 turn into $77,945.00. Probably many since this is touted as “the place to be.” Now, how many realize that the same $10,000.00 invested in gold during that same time would be $126, 596.00. That is massive outperformance that is RARELY, if ever, mentioned on the financial game shows. Add to that the fact that the “markets” have been artificially propped up with “printing and buying” and gold has been artificially suppressed with spoofing and naked shorting. (source: Investing.com) This suggests that if market forces were allowed to function as planned (true price discovery) the difference would likely be exponentially larger. I believe the day is coming when we will see this.

moreADV Happy Thanksgiving!

Mike Savage

Happy Thanksgiving!

I am extremely thankful for many things this year. I remember long ago my grandfather- who had far more wisdom than I realized at the time- made a comment that, as I got older, I appreciated it more and more. “When you have your health, you have everything.”

I am thankful for the health that I, and my family, enjoy.

I am thankful to all the people in my life. Every single one has contributed to helping me become who I am. My wife has been a rock for our family and a great mom. My kids, who I should have been teaching, have probably taught me more than I taught them! I am proud of everyone.

The people who have stood by me and have shown their trust in my judgement over the years are a true blessing that I am FAR more thankful for than I can communicate. Many times, I have thought- if only I played the game I would have exponentially more “money,” but I couldn’t do that because I don’t believe in the charade. I would rather sleep at night.

Finally, after a longer than expected wait, things are turning out the way we anticipated.

Nobody has a perfect life. We all have our challenges and disappointments but on a day like Thanksgiving we can sit back and appreciate all of the blessings that we have had and the people that have helped us along the way.

moreWeekly Article 11/26/2025 - ADV Weekly Commentary

Mike Savage

At this time of year, I always take some time to review how the year has gone and what adjustments may have to be made going forward.

Even though the economy is crumbling beneath us the “markets” have been moving higher. Having said that, I believe the worse it gets the more profits we are likely to see. The main reason is that to save the bond “market” which underpins most other “markets” like stocks and real estate, the Fed will have to conjure up trillions out of nowhere and debase our dollar at an even faster pace than is taking place right now.

I have said it many times, but it is imperative that you understand that the Fed does NOT have a magic wand to reduce rates. Anything longer than the overnight rate and the “Money” must be conjured up out of nowhere to buy the bonds and lower the rates. It is a simple trick to make the “market” think there is FAR more demand than actually exists.

The very act of “printing” increases the SUPPLY of dollars and weakens its purchasing power. Translation- Everything costs more than if they didn’t “print”. Hard assets and gold in particular should be MAJOR beneficiaries going forward.

Keep in mind that our main thesis has been that the dollar is weak and appears poised to get much weaker. There doesn’t appear to be any rational idea that could change my thinking about that. It appears to me that there are two choices- sacrifice the dollar to prop up stocks, bonds and real estate (assets that those “in charge” own) by “printing and buying” or save the dollar by not “printing and buying” which would lead to an almost immediate collapse of most asset classes. Human nature and history imply that option #1 is the path they will take.

moreWeekly Article 11/20/2025 - ADV Reality Check

Mike Savage

Most people appear to believe that our current economic environment is not ideal, but I don’t think they have ANY idea of how bad things actually are.

While we hear the cheerleaders in government and on the financial game shows touting the “great numbers” reality is telling a FAR different story.

Last week I wrote about the many problems in the subprime lending space. Problems always show up in the weakest link first and many times lead to the entire chain snapping.

If inflation were indeed 3%, as we are told, the many problems we are seeing would probably not be as bad as they are. John Williams of Shadow Government Statistics reports that the CPI (Consumer Price Index), using the methodology of the 1970s, is actually 10.8% - not the 3% we are being sold.

The magnitude of the difference is stunning. Using the rule of seventy-two, the 3% inflation rate would double your living expenses in 24 years. At 10% your living expenses would double in 7.2 years. The difference would be:

· Assets at $100.00 would cost $200.00 in 24 years at 3% inflation, with 10% inflation it would cost over $800.00 if the 10% persisted.

While this is important for longer-term planning the real problem today is that prices are rising FAR faster than the “official” numbers and those that were getting by before are falling further and further behind.

moreWeekly Article 11/13/2025 - ADV Really?

Mike Savage

One of the most important questions that we can ask would be “what is it that we don’t know that could impact our investments going forward?” This question has become much more important since the 2008 meltdown. Why? Because many changes were ushered in after the fact that, in my opinion, were meant to keep the public in the dark about the real state of our economy and “markets.”

One of the major changes that took place is that the Fed allowed banks to report bonds held at face value even if the actual bond was actually 50% below that if it were to be sold today. This is what constitutes a sizable portion of the reported 500 billion or so of “unrealized losses” on the books of the major banks. I also have to wonder about the commercial real estate loans that are being offered extensions and modifications to avoid having to report losses that are likely to come at some point anyway.

While to many it will likely appear that when the SHTF moment arrives, that it will be a surprise. Looking at the “numbers”- if you believe them-it would be a surprise. I don’t believe the numbers are even remotely reliable, but almost all “investors” use the numbers to make decisions.

We have to keep in mind that as a problem shows up, it generally shows up in the weakest hands first. An example would be the subprime mortgage meltdown in 2008. Fed Chairman Bernanke at the time reassured everyone that this was a small thing and that it was “contained.” How did that work out? Pretty similar to inflation being temporary, transitory, and now sticky. I am waiting for elevated and possibly parabolic. Let’s all hope I am wrong on that.

moreWeekly Article 11/06/2025 - ADV Drowning in Debt

Mike Savage

Debt. We are drowning in it. If we were issuing debt to rebuild our infrastructure or fund profitable endeavors that would produce gains over time it would be one thing. The debt that the USA is drowning in is the worst type of debt that is being used to pay interest, pay to feed people, fund unending wars, and many other things that, once spent, all that is left is the increasing debt itself and the interest that gets accrued going forward.

This is just the Federal government. Many states are in a similar situation. Many companies and households are also going deeper into debt. Companies are also issuing debt to pay dividends or repurchase their own stocks- to give the illusion that the enterprise is strong. Many individuals and families are using credit to keep up the illusion of their lifestyle where wages have not kept up with rising prices.

Many cracks are showing. The $38 TRILLION that the USA admits to owing is just the beginning as unfunded liabilities and off-balance sheet items are multitudes higher. Many cities and states may have already collapsed if it weren’t for the hundreds of billions in bailout money during the CV19 lockdowns.

As I research many companies, I see many balance sheets (many household names) that actually have more DEBT than EQUITY. With a drastically slowing economy this could be a dagger for those companies. This does not bode well for future job growth or even stability for workers today. We are already seeing massive layoffs among most industries, and the numbers are rising.

moreWeekly Article 10/23/2025 - ADV Pullback Is Positive?

Mike Savage

We have spent most of the year watching gold, silver and the companies that produce these assets fly higher. We are now seeing a pullback that, in my opinion, could be a positive development.

While it is entirely possible that those “in charge” are performing a smash down- as they have been doing for many years- it appears to me that it is a bit more than just that. I say this mainly because they have been intervening in the “markets” all year and it hasn’t worked up until now.

It is entirely possible that after a MAJOR run-up that many who have had major gains have decided that now is the time to take profits. It is also entirely possible that there is a more sinister reason for this. That would be that there is a SERIOUS liquidity crisis taking place and gold is giving a warning that something big is about to happen. I say this because there are warnings from JP Morgan and many others about loan losses on subprime, private market and commercial real estate debt.

This is a classic illustration of how too much debt can crush an economy. While the debt seems to be issued in unlimited amounts, we have a limited amount of assets or COLLATERAL. As that collateral sinks in price- think about automobiles being a depreciating asset and commercial real estate prices crashing in many major cities, the loans in many cases are underwater leading to defaults.

moreWeekly Article 10/16/2025 - ADV Signs

Mike Savage

Signs …

I hear many politicians and many wealthy people touting how great the economy is. I really have no reason to not believe that for them, it is great. Those with assets are always happy to see easy money and rising asset prices.

Many people have wondered out loud – how can those “in charge” just keep conjuring up cash in exponentially increasing amounts and not have massive inflation? Actually, we DO have massive inflation-albeit FAR less than I would have envisioned with the type of “printing” that has taken place. Many are just looking in the wrong places.

The inflation that has been most prevalent-SO FAR- has been in asset prices that have become so inflated that the PRICE of stocks and bonds have NO CORRELATION to the VALUE.

Most people, when they see stocks rising, they just ASSUME that the VALUE must be rising also. Where we are now that could not be further from the truth. Stock buybacks, Fed “printing and buying” and outright manipulation have raised the PRICE of most stocks and bonds FAR beyond any VALUE that exists.

With the easy money of the past 10-15 years many companies have bought homes and because of the excess demand for housing most of our young people look at home ownership as an American nightmare rather than the American Dream. Big companies and banks win- we lose.

moreUpdate 10/07/2025 - ADV Disturbing Signs

Mike Savage

I have been at this for a long time, so I have seen booms and busts and have lived to fight another day. I have also spent a lot of time researching events that took place long before I was even alive. Because of this research and longevity, I tend to see things a lot differently than most.

I have written in the past that if any one of us had the power to “print” money- particularly if we were the only people with that privilege, we would likely NEVER give it up. It is no surprise that since the central banks have that privilege that they too, are unwilling to give it up.

This is important to understand when it comes to stock manias also. If you have an advantage that you are able to exploit you certainly want to exercise that advantage and involve as few people as possible to maximize your profits. In addition, if too many people catch on you lose your advantage and the game could end. This is a MAJOR reason to doubt those that tout “trading secrets that made me rich.”

Another piece to this puzzle is in private equity. There is a lot of buzz in our industry about private equity deals and ETFs that can let the little guy get in. Where were these deals a few years ago? My guess is that, as some great opportunities presented themselves, the insiders kept it quiet and made large sums of money in many cases.

moreWeekly Article 10/02/2025 - ADV Major Signs

Mike Savage

Last week I wrote an article that really got ME thinking. In it, I was giving reasons to support why those on the financial game shows were not doing anyone any favors in promoting the idea that now is the time to sell gold.

What I did not expect was that in doing the research for that article, it really crystallized my own thinking.

Because of the massive run-up in gold, silver, and miners during 2025 I have been a bit cautious about adding new positions as I have been waiting for a pullback that still may come but has not yet.

I am increasingly sure that any pullbacks are unlikely to be too deep and will likely not last for any lengthy period of time. I am also fairly sure that the price in the future will be FAR higher than it is today. My reasons are many but start with:

· We have a President, Treasury Secretary and Fed that want a weaker US dollar and lower interest rates which would hasten our downward trajectory and our purchasing power. I believe they will get their wish- I just hope it doesn’t happen in an uncontrolled manner. Keep in mind that gold (and other hard assets) does not change- just the amount of fiat currency that you need to purchase that same ounce. It is not how high can gold go- it is how LOW can the dollar fall.

moreWeekly Article 09/26/2025 - ADV Gold Misinformation

Mike Savage

As I watch the financial game shows, I don’t know whether to laugh or cry. I laugh at the lack of knowledge about gold and silver in particular but because of the negative spin they put on it many have missed out on substantial gains. As a matter of fact, the best performing asset class since the year 2000 is gold- and that is with MAJOR price suppression efforts that are still ongoing. I cry for those misinformed.

As a matter of fact, I have seen is “experts” coming on and saying gold has topped- SELL.

Keep in mind that all gold does is hold its purchasing power and exposes the weakness of fiat currencies. I remember the same narrative in Japan in 2015 when gold reached 120,000 -yes one hundred twenty thousand yen. Today, it takes 562,595 yen to buy one ounce of gold. They started “printing “, before we did. It is not how high can gold go- it is what is the floor for the dollar. An important point to remember when hypothesizing about price tops.

I hear no mention of central banks buying hundreds of tons of gold yearly. I hear nothing about how JP Morgan famously said, “Gold is MONEY all else is credit”. The main reasons to keep the price of gold down is to make the dollar appear strong and as a good store of value. Obviously, the central banks are aware that dollar assets can be seized and, on top of that, there is NO CHANCE the debt will be repaid with the dollar maintaining anywhere near its current price. Notice I said price because as a unit of debt it actually has no intrinsic VALUE. Only perceived value.

moreWeekly Article 09/19/2025 - ADV Mania Vs Value

Mike Savage

I have written many times in the past that every time there is intervention (Conjuring up cash and buying stocks and bonds) the chasm between the PRICE of a stock or bond and its actual VALUE gets wider and wider. Since this has been going on for decades- and has really taken off since the 2008 meltdown the reversion to the mean will likely take on a new meaning for the word MEAN.

With many large companies buying back shares to goose up the price of their stocks and to also hide the fact that they are not performing as well as expected by reducing the outstanding shares and reporting earnings per share on less shares, the actual amounts have become astronomical. It also speaks volumes that instead of doing R&D and investing in new ventures they think the best use of their cash is to give an artificial boost to the share price- usually well-timed around C suite bonus time.

Add in the fact that the Fed and Treasury are scrambling to keep the bond “Markets” from imploding with who knows how many trillions and we have a toxic mix of NO PRICE DISCOVERY for virtually any asset class.

Keep in mind that as the Fed announces lower rates it only has control of the overnight rates that they can just say it and its done. All of the other maturities have to be bought with freshly created currency backed by nothing in what appears to be UNLIMTED amounts. This is EXTREMELY inflationary. Just wait until private corporations join this party and start issuing stablecoins!

moreWeekly Article 09/12/2025 - ADV No Historical Precedent

Mike Savage

Inflation. I believe it is important that I write this article at this time because it appears that we may be heading for unprecedented levels of inflation very soon.

If you look up the definition of inflation you get a bunch of baloney about rising prices over time and a broad rise in prices for goods and services over time. Most sites use this explanation, and it is promoted by those “in charge” because it relieves them of their responsibility FOR the inflation.

A more accurate description of INFLATION comes from Britannica Money (Encyclopedia Brittanica) which says that “Inflation refers to the general increase in prices or the MONEY SUPPLY, both of which can cause inflation.” Notice, I said “more accurate.”

The reason it is more accurate in my opinion is that they mention MONEY SUPPLY. What they fail to mention is that the increase in money supply is what generally causes the rising prices. Other factors, like scarcity of items could cause prices to rise for this or that, but the overall cause of inflation is currency debasement by conjuring up currency units out of nowhere in nearly unlimited amounts.

In the beginning many (particularly those that own assets) love inflation because the inflation shows up by artificially raising the PRICE of their assets. Notice I said it raises the PRICE- Not necessarily the VALUE. It also makes it harder for those starting out to participate because of a rising barrier to entry.

moreWeekly Article 09/05/2025 - ADV Uneasy Feelings

Mike Savage

Gold has been moving relentlessly higher. Gold stocks, which have lagged in performance in recent years have been playing catch up in the past few months.

In one way, I am loving the moves because it validates what I have been predicting for quite some time. As I have written in the past- you can suspend reality for a while, but you can’t keep it going forever.

In another way, I am not really happy with what I am seeing. I have an uneasy feeling that the downturn in propped-up assets like stocks, bonds, and real estate- that in my view is LONG overdue- may be on its way.

There are so many signs out there that are being hidden in plain sight that it is hard to know where to start. First of all, this is a global problem so to focus just on the US would leave out dozens of potential black swans.

I believe that this all begins and ends in the debt (bond) “markets.” They have been artificially manipulated to keep prices high and yields low. Different countries give different reasons but the main reason is to make funding governments less expensive so they can continue borrowing beyond their means. It also leads to inflation and a lower standard of living for you and me. In addition, it allows corporations and individuals to take on more debt.

moreUpdate 08/29/2025 - ADV Labor? Day

Mike Savage

As we approach Labor Day many are looking forward to the changing seasons, football and cooler weather. Goof that I am, I am thinking about what the day means. A celebration of America’s work ethic and thrift.

In the past I was always proud of the fact that with hard work and determination you could accomplish anything in our great country. I saw the backbone of America when I was in high school and college and worked at Westclox and American Nickeloid- just two companies that provided good-paying jobs that would allow for a single wage earner to support a family.

As time went on, many of these factories closed up and moved to locations with cheaper labor- like Westclox initially moving to Georgia prior to moving to Mexico.

As my children were growing up it became clear that the world I had grown up in was rapidly changing. My advice to them was to “do what you love because if you don’t love what you do you won’t be good at it”. In addition, “You better get really good at something because the days of being able to do menial jobs and survive are over”.

My kids are now all grown adults. I am proud to say that all four of them heeded my warnings and are excelling in their careers. I feel fortunate that their time came along just prior to our current state of affairs. While my advice would be the same, I believe that carrying it out today would be FAR harder than it was even 10 years ago.

moreWeekly Article 08/28/2025 - ADV Mike Disagrees

Mike Savage

There is a fellow named Martin Armstrong who has been putting out information based upon his SOCRATES computer program. Over time, he has been very accurate in his forecasts. It has been a mistake to bet against his prognostications.

At this time, I am going to disagree with one thing that he is talking about. Namely, that he believes the US Dollar is going to strengthen. The reasons he gives date back to World War 1 and World War 2 when cash flowed into the USA because of the wars in Europe and capital controls put in place.

His program says that war is coming to Europe no later than 2026 and that is his reasoning behind his assumed dollar strength.

While it may make sense in looking at history, this is what I believe is being missed.

During the time of WW1 and WW2 the USA was viewed as a safe haven. We had a rule of law, liquid markets, and an ocean between where the carnage was taking place and our homeland. It is easy to connect the dots and assume it will be the same this time.

As Lee Corso says on College Football GameDay “Not so fast!”

Much has changed since World War 2 and most of those changes have really accelerated in the past 5 years. How many countries actually view the USA as a safe haven today? We weaponized our currency and treasuries against anyone who has not followed our directions. The rule of law has been flipped on its head with rules for those who are “in charge” and rules for the rest of us. The USA is functioning as a banana republic. I called this a decade ago, but it is so obvious now it can’t be ignored.

moreWeekly Article 08/22/2025 - ADV Inflation!

Mike Savage

The signs are everywhere that we are getting closer and closer to a day of reconning. Not only the US economy but the global economy as well. The numbers- even the fabricated ones that are meant to make things look better- are bad.

Inflation is rising and even the Fed has come out this week saying they see another bout of inflation coming “soon.” Of course, if they lower rates in September as they are expected to do it will weaken the currency and cause higher inflation.

While prices continue to rise so do JOB LOSSES. MarketWatch reported that initial jobless claims rose to 235,000. Continuing jobless claims climbed by 30,000 to 1.972 MILLION- the highest reading since 2021 during the pandemic.

Many companies are reporting earnings and even such iconic companies like Wal-Mart, Home Depot and most chain restaurants are warning that the consumer is hurting, and they are not spending on luxuries like they were. This is likely because NECESSITIES are costing so much more these days.

While we can see this information pretty easily by watching the financial game shows and information channels like Yahoo Finance, there are far more serious issues that are not being covered. This would be in the bond “market.”

moreWeekly Article 08/14/2025 - ADV Reality Check

Mike Savage

Things are FAR worse than most people know.

Inflation is far higher than reported.

More jobs are being lost than created- even though “official numbers” are manipulated to keep the majority as clueless as possible.

Lies are being told to cause people to believe that tariffs are being paid by others rather than by our corporations- and eventually by us. As a matter of fact, Warren Buffett has said that tariffs are an act of war. If you read my update earlier this week you may see the reason.

While the retail public is almost all-in on the stock “market” with margin debt sitting at over $1 TRILLION now, many insiders have been quietly shedding their positions in their own companies. What could go wrong? (Michael Belkin of Hyperpyron Research)

I have consistently written about how our economy is collapsing. Many people think that, because the government “numbers” don’t tell the same story I must be wrong.

Let’s just take a look at numbers that can’t be manipulated and see if my theory of a coming economic collapse is well underway or not.

First of all, the US government is spending like drunken sailors. Wars, having the Fed conjure up cash to fund current spending while also paying off maturing debt, absorbing debt being sold by foreigners and even paying interest on what is currently owed. The sad part about this is that the DEBT created to keep the illusion alive is being counted as GROWTH. When, in reality, all that is growing are our unpayable debts. So, GDP numbers that are touted as showing “growth” are nothing, but a mirage and our debt situation is far more severe than most have any idea about.

moreUpdate 08/11/2025 - ADV Tariff Truths

Mike Savage

In the old Nazi playbook of the 1930s it was said that “tell a lie often enough and it becomes the truth”.

I have seen reports and have heard people saying how the USA is collecting BILLIONS from other countries via tariffs. The media is portraying this as a big WIN for us! Most have been duped by this reporting.

In my opinion this is a bald-faced lie.

Last week our president announced that without tariffs we would have a 1929 type crash.

While the tariffs can certainly hurt the countries that the tariffs are placed upon it is not in the way being presented by our “leaders.”

Of course, the increased tariffs raise costs for importers, wholesalers, and retailers and therefore, make it likely that FAR fewer orders are going to be made and could cause a substantial slowdown in economic activity in the tariffed area. This is not much different from those “in charge” picking winners and losers in the economy.

If we go back to the Great Depression one of the contributing factors were the tariffs of the time. This is economic warfare and could slow down economies globally if continued. I believe that this is a sign of desperation for the USA and is nothing but an additional tax on we the citizens to keep the government afloat as a trillion dollars is being added to our national debt every one hundred days. This is what is admitted to- what are we NOT seeing “off the books”?

moreWeekly Article 08/08/2025 - ADV Major Changes

Mike Savage

I hear many people who believe that there is no other currency out there that could supplant the US dollar as the world’s reserve currency. That may be true at this moment but in my opinion, there is growing evidence that the world does NOT need a reserve currency. I said this 5 years ago.

The evidence I am seeing starts with the BRICS where many members are already trading in local currencies. Even our traditional allies like France and Japan have been buying Chinese goods with local currencies. In the past if you wanted to buy oil or other commodities you needed to exchange your currency for US dollars to make the purchase. This led to unprecedented demand for our currency. Today, many trades are being done without the conversion to dollars but are being settled in the currencies of the trading partners. This is not just the BRICS and global south anymore- it is global.

As I have written in the past, the fact that the USA has had the world’s reserve currency has allowed us the extraordinary privilege of conjuring up cash in unbelievable amounts to buy MANY goods that we could not afford with our own production. It has allowed us to go into debts that are unparalleled in world history. Because of the demand created by needing the US dollar in almost all international trade we were able to live FAR above our means for decades.

moreWeekly Article 07/31/2025 - ADV Reality?

Mike Savage

It never ceases to amaze me the lengths that those “in charge” will go to so that the average person stays so confused that they don’t know what to believe.

Most of us are well aware of the massaging of numbers to hide the true state of our economy -like not counting around 100 MILLION working age people who don’t have a job in the unemployment numbers. Many are also aware the full-time jobs are disappearing at an alarming rate and part-time and gig jobs are growing. Of course, every part-time job is counted as “job growth” in the massaged numbers.

While this sleight of hand makes “job creation” look good in reports, the actual impact on our economy and society is decisively NEGATIVE.

For many who don’t pay attention to the bond “market” it appears that the USA is having no trouble funding our deficits. For those who are paying attention, it is VERY apparent that the Fed and Treasury are working together to keep rates from exploding higher as most of the rest of the world is SELLING treasuries rather than buying them. With the sheer volume of sales by central banks and others, rates would have skyrocketed already if there was not MASSIVE buying by the central bank.

moreWeekly Article 07/26/2025 - ADV Silver

Mike Savage

I have written many times that I believe that silver is the most undervalued asset on the planet. I still believe it-even though the price has risen approximately 25% here in 2025.

The price suppression scheme that has been exposed in numerous court cases- and has been visible on the charts for over a decade- has made the likelihood of a MAJOR price move higher much more likely. The reason is that, as major banks and others suppress the price, the economics make no sense when pondering whether to find new supplies. Add to that the myriad of uses for silver and you have a perfect storm for a far higher price at some point.

According to Bloomberg, silver has been in a structural deficit since 2021. What that means is that the demand for the metal has outpaced supply. The cumulative shortfall from 2021-2025 has been 800 MILLION ounces or 25,000 TONS that were used or purchased- more than what was actually produced. At some point this will have a major impact.

It does not pay to try and pick a time because there are powerful financial sources that have kept the suppression scheme going for far longer than I could have ever imagined.

The main reasons for a meaningful revaluation are:

moreUpdate 07/25/2025 - ADV Lower Rates?

Mike Savage

I was passing by a TV this morning and saw a segment on one of the mainstream media stations that was parroting the propaganda that we need lower interest rates- particularly mortgage rates.

One thing we learned long ago is that if you tell a lie long enough many people will believe it to be true. This is a fitting example of that.

If we look at the major reason that most of our upcoming generation cannot afford “the American dream” of home ownership can be directly tied to LOWER INTEREST RATES.

When rates are artificially lowered it is not like the Fed or other central banks wave a magic wand and we get lower rates. They have to conjure cash up out of nowhere and BUY THE bonds to get the rates to come down. This action causes INFLATION and the price of EVERYTHING to rise.

In addition, those actions allow corporations and private equity funds to borrow cheap money. Many companies like Blackstone and Blackrock have bought up entire communities and have made prices FAR higher than traditional supply and demand would dictate. This has helped price a large part of an entire generation out of home ownership and now, even renting is becoming a burden as the demand for rentals increases.

moreUpdate 07/21/2025 - ADV Genius

Mike Savage

While I was away on vacation last week a major event took place here in the USA. While it is receiving VERY little attention- probably on purpose- in the media- it is an event that will likely impact all of our lives in a negative manner.

The event was the passage of the “Genius Bill” which allows private corporations to issue stablecoins. While this sounds harmless enough it appears to me to be a workaround to get a system of total control without the backlash of rolling out a CBDC (Central Bank Digital Currency). Genius for WHO?

When our President issued an executive order that the USA would have no CBDC there was a little hope that we may avoid the fate of the Euro and other places. In reality, it was quite likely done to throw us off and this was the plan all along. One reason to ponder this is that Mr. Trump’s sons launched their own stablecoin just months ago. Great timing?

Think back to how our country was invaded in the past 4 years. While the government was prohibited from conducting many tasks because of the constitution and laws they turned to entities (NGOs- or non-government organizations) to carry out what they wanted done with NO OVERSIGHT. Sometimes what government cannot do on its own- private companies can.

moreWeekly Article 07/10/2025 - ADV BRICS

Mike Savage

WeeklyArticle07102025

Many of us here in the USA seem to think that just because things don’t happen in a nanosecond that they will not take place. Much of the rest of the world has a highly different view and they take a longer-term approach.

One glaring example of this would be the BRICS, who have been planning a multi-polar world since at least 2009. There have been many people who have believed that the BRICS would come up with a new currency and that it would knock the US dollar off of its reserve currency perch. Many have said that this new currency would be backed by gold and dominate in global trade. While this still may take place at some time in the future, the real idea appears to be to trade in local currencies right now and move to a SETTLEMENT SYSTEM that would not involve a third party- US Dollar.

I believe that if the members of BRICS were not fearful of the US military ruining their day this would have likely taken place already. Instead, they are moving slowly and methodically to bypass using the dollar as settlement in cross-border trade. As President Putin has said- We are not shunning the use of the US dollar but have been excluded from using it. Of course, the seizing of Russian assets has not been lost on the rest of the world as everyone sees that the US has no problem using its currency as a weapon. Now, it is just self-preservation that is adding more and more fuel to the de-dollarization movement which has led to a 10% drop in the dollar index so far in 2025.

moreWeekly Article 07/03/2025 - ADV 2025 So Far

Mike Savage

As we head into the second half of 2025, I thought it would be a good idea to see where we currently stand and where we might be headed in the next 6 months.

I stated at the beginning of the year that by year’s end we might not recognize the economy we see today. I still believe the same right now.

After a rough start to the year for the major stock indexes, they have recently rallied on the back of MAJOR corporate buybacks and algorithmic trading by bots following headlines and chart numbers- all masterfully manipulated to prop up the illusion as a strong market and therefore-economy. Currently, the economic numbers and stock “markets” have little to no correlation. Another MAJOR reason for the uptick would be the demolition of our US dollar’s purchasing power.

While things APPEAR to be tranquil there is a lot of turbulence under these “markets.” An interesting note came from Zero hedge where, while the S&P index is hitting all-time highs, there are currently ONLY 22 OF 500 companies that are at all-time highs. Historically, this is a VERY bad sign going forward. NO MARKET BREADTH.

As I write this on July 1st, gold has risen 25% since January 1, 2025. Silver has risen 14% and large gold miners have risen 49% and juniors 52% overall.

moreWeekly Article 06/27/2025 - ADV The Cost of War

Mike Savage

The COST of War.

Because I write about economic matters many may think that I am referencing the “money” it will cost to execute the multitude of wars that the USA is actively engaged in.

While it is an important fact that the wars are leading us faster and faster to the economic cliff that we have been warning about for years, there are factors that just might be more important.

It is becoming increasingly obvious that no matter who APPEARs to be calling the shots, there is an entire complex that is actually running the show.

The largest economic cost, in my estimation, is the loss of confidence not only in the US dollar but more importantly, the loss of confidence in our RULE OF LAW and the honesty of our words and promises.

Just that after World War 2 the USA had become the manufacturing hub of the world and also had the world’s reserve currency. It was gifted with the reserve status because of our RULE OF LAW and our honesty in keeping our word along with most of Europe being decimated by the war.

We have gone from being the world’s beacon of hope to its harbinger of destruction.

I started following this in the late 1980s when it became obvious to me that geopolitical events could have meaningful impacts on our investments. Since then, we have seen our “defense” department overthrow numerous governments and have been agitating in dozens of others. Think COLOR REVOLUTIONS.

moreWeekly Article 06/19/2025 - ADV Debt Slaves?

Mike Savage

I am writing this on Juneteenth. My understanding is that this was the day that slavery was ended in America. Actually, the Emancipation Proclamation was issued by Abraham Lincoln on September 22, 1862, and scheduled to take effect January 1, 1863.

Because of the extension of the civil war the actual final emancipation was June 19, 1865, when Major General Gordon Granger ordered final enforcement of the Emancipation Proclamation in the last holdout- Texas.

In January of 1865, the thirteenth amendment abolished slavery in America.

While the abolition of slavery was a godsend for many- and many still believe we are all free. I believe that slavery was re-instituted in the USA in December of 1913 when congress passed the Federal Reserve Act.

The initial idea was sold to the USA as having a bank that could backstop the economy when there was a lack of liquidity and smooth out the ups and downs in the economy.

What did we actually get? We got a PRIVATE bank that issued Federal Reserve Notes (DEBT).

Ever since, we have been misled to believe that the Fed is part of the government- it is NOT. It is owned by private major banks. It is not related to our federal government and has no reserves. Even the name is misleading.

moreWeekly Article 06/13/2025 - ADV Chaos

Mike Savage

The world seems to be hurtling towards a series of events that could determine our future for a long time to come. There are rumors that Israel is ready to attack Iran. There appears to be no answer in Ukraine at this point where if either side were to back down it would look like a stunning defeat. China is well known to be wanting to reunify with Taiwan-peacefully or with any means necessary.

These are all stories that are fairly well known. There are other stories that are not as well reported that are just as disturbing but not as well known. An example would be the riots in LA and now spreading across the country. There are reports that these riots are being funded and are planned as opposed to being some random acts of rage. The help wanted ads in Craigslist are an example. The “fact checkers” denials along with other admitting that they were indeed placed leads me to believe the reports.

My first thought was “here goes Soros and his minions again”. In watching some reports there are some “experts” that are saying that these riots- while more than likely having SOROS’ fingerprints on it are also likely being funded by China, Iran and North Korea.

There are reports of hacking, smuggling of biological materials, and other events meant to weaken the USA.

moreWeekly Article 06/06/2025 - ADV Compliance Or Else!

Mike Savage

I have noted in the past that I do not trust either side of the aisle in our US government. I, and others, have referred to the crowd in Washington as two wings of the same bird.

As I look around, I see nearly half of the people think that the “right” cannot do anything right. The other nearly half believe that the left cannot do anything right. This can be explained by where you get most of your “news.” I use “news” because actual reporting in the mainstream media has become NOTHING but opinions and propaganda- regardless of which side you see yourself on.

A perfect example would be our president. Many believe he can do no wrong. Many believe he can do no right. Personally, I believe that he has done some good things and some things that appear to me to be terrible.

To me, the social issues and the protection of our borders have been decisively positive. On the other hand, it appears to me that he is leading us straight into a new system of total control by those with ulterior motives.

I started having uneasy feelings early on when I saw millions of dollars of donations by big tech companies. It seems that the Federal government is seizing control of AI (Artificial Intelligence). In fact, a huge part of the big, beautiful bill that almost nobody is mentioning is that, in it, the states are NOT ALLOWED to make any rules about use in their individual states for a period of 10 years. Most likely, this temporary seizure of power will be like Nixon’s temporary halt of exchanging dollars for gold in 1971. They know in 10 years it will be too far down the road to resist.

moreWeekly Article 05/29/2025 - ADV Not The Same

Mike Savage

I have been seeing many “experts” expecting gold to tank in price before it finally takes off to catch up with all of the “printing of money” that has taken place over the last 50+ years.

Personally, I believe that these people may be “experts” in looking at history and charts, but they are missing the bigger picture.

I hear most of their explanations that compare today to 2008. Many respected market commentators appear to be making the same mistake.

While it is likely that the takedown in the stock “markets” and freezing up of the credit “markets” may be similar to what we saw in 2008 (probably FAR worse), there has been a MAJOR shift in sentiment that many seem to be ignoring.

In 2008 when we saw credit markets freeze up and the stock market lose over one-third of its value the major beneficiary was the US dollar and US Treasuries. Many of these so-called experts point out that since that is what happened last time it will be the same this time.

My take, based upon what I am seeing, is that the next beatdown will be caused by a collapsing US dollar, excessive “money printing,” to kick the can further down the road, and a collapse in the confidence not just in the US dollar but the USA itself. We are already well on the way.

moreWeekly Article 05/22/2025 - ADV What Do They Know?

Mike Savage

Many people over the years have asked me “What do the really wealthy know that we don’t?”

I have written many times that truly wealthy families pass wealth from generation to generation with gold, real estate, and art. Personally, I would also add stocks of companies that produce real goods and other hard assets. This is not to insinuate that I am in their company yet.

Many of us who see people with a lot of “money” and consider them rich are making a common mistake. The mistake we are making is that those currency units still hold anywhere near the value that they once had.

We also make the mistake of assuming if someone has a lot of assets that they are rich. They may be, but if their liabilities (loans and mortgages) are high, it is only an illusion of wealth.

Here in the USA our US dollar has lost over 97% of its purchasing power in the last 100 years. In other words, someone with a million dollars then would need $33.3 MILLION today to have the same WEALTH that $1 Million dollars held then. In Zimbabwe everyone was a billionaire a few years ago. Unfortunately for them, it cost a trillion Zimbabwe dollars to buy 3 eggs.

Even myself, I remember walking through my small town that I grew up in during the 60s and 70s thinking if I could make $100.00 per week I could live like a king- and I could. Today, I would be homeless.

moreWeekly Article 05/14/2025 - ADV Opinion

Mike Savage

I think it is a good time to put out what my perspective is on the current economic situation which is, to say the least, interesting.

One day we have tariffs- the next day we have a cooling off period. “Markets” are making up some of the losses incurred earlier this year and the gold has cooled off and is currently giving back some of the gains we saw earlier in the year.

The main question has to be, will this current paradigm last. My answer is a resounding NO.

It is extremely obvious that every trick in the book is being used to keep the stock and bond “markets” elevated. Of course, these are not the markets of the past where a willing buyer and willing seller set the prices of stocks and bonds thousands of times per day which led to true price discovery. Today, there in NO PRICE DISCOVERY anywhere. This is what makes this current situation so dangerous.

Currently, we are conjuring up cash to pay interest on our existing debt, buying bonds that other countries are selling, buying debt issued to retire existing debt and funding current spending. The current spending part is over $1 TRILLION in deficit spending. This does NOT include off-the books spending which could also be in the trillions. All this is doing is putting the day of reckoning off and keeping yields from exploding higher- leading to that day of reckoning whenever it happens.

moreWeekly Article 05/08/2025 - ADV Get Ready!

Mike Savage

As I was reading though some historical quarterly reports by some of our leading companies from the last century, I was struck not by what I saw but what has been missing for some time from today’s quarterly reports.

In the 1970s and 1980s and probably as far back as you would like to go many quarterly reports not only reported earnings, expenses and future outlook but also took pride in the good they were doing for the public. They boasted about their service and their contribution to society.

Today, while all of the numbers that are reported are still intact the message has changed from their contribution to society to how they have increased earnings and created “value” for their shareholders. In other words- how they are serving not the public but the owners (top 10%).

In the past there was a commitment by companies to their employees and to the public. Today, it is all about earnings and padding the pockets in the C suites. Shareholders applaud layoffs because they believe that profits will rise. Buybacks are welcomed even if the major beneficiaries are those at the top because the buybacks will create a better-looking bottom line. This allows the PRICE to rise even if the VALUE is not rising or even falling. In the past share buybacks were illegal because was deemed a form of insider trading.

moreWeekly Article 05/01/2025 - ADV Headlines

Mike Savage

Is it just me or are you also noticing that what we are being told and what is actually happening are two grossly different things?

We hear from the financial game shows that “the economy is strong.” This, while ALL of the major economic data is pointing sharply downward. We hear that the “consumer is strong” because they keep spending. What is rarely, if ever, mentioned is that with rising prices we have no choice but to spend more to buy the same necessities. What also is rarely mentioned is that bankruptcies, foreclosures, credit card delinquencies and auto loan defaults are rising rapidly.

Zero hedge has also reported that people are using Buy now-pay later even for food and in some cases are even late in paying that.

What does this say about our solvency? We have a debt-based system that relies on collateral to function. As the collateral starts to collapse the banks can use creative accounting to hide the cracks. The central banks can conjure up credit to give the illusion of solvency where none exists without the money creation.

This has been going on since at least 2008. The problem? If collateral (stocks, bonds, real estate, etc.) collapse so does our current system. This is the reason that the central banks were so keen on propping up the stock and bond “markets.” Real Estate was the beneficiary of low interest rates and high bond prices.

moreUpdate 04/25/2025 - ADV Too Late? Don't Think So

Mike Savage

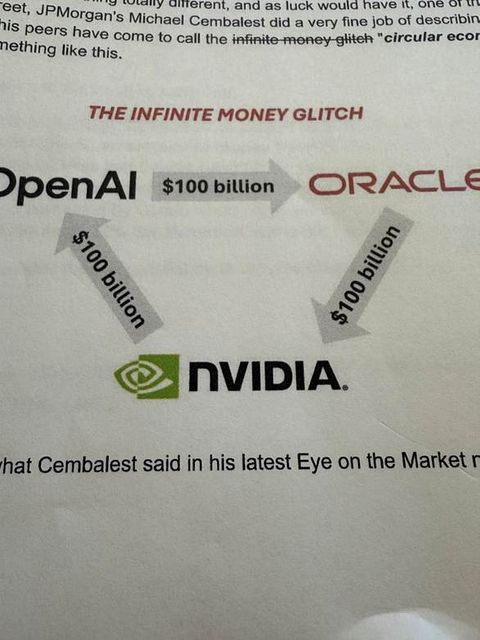

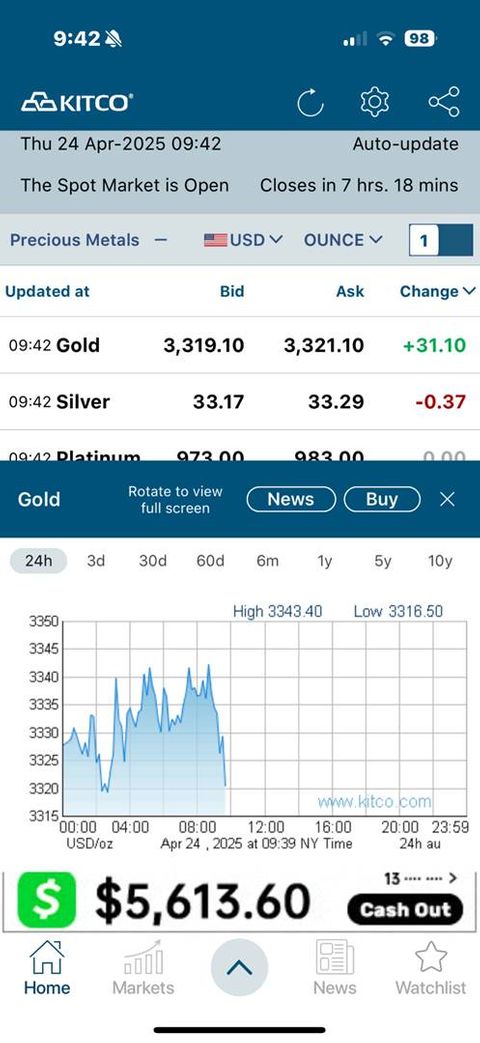

Sometimes a picture is worth one thousand words. I write often about the suppression of particularly gold and how it is done by selling paper contracts into the “market” when the price threatens to break out and go higher.

I am not sure how many can really understand just how massive the manipulation is.

For some idea of how big this you may want to refer to the Financial Times article from September 29, 2020, where JP Morgan paid a $920 Million fine for this practice. They are not alone.

Keep in mind that the pictures I am putting on this note is just for April 24, 2025, from around midnight until around 10 AM. This has been going on likely for decades, but I am sure of the fact that is has been happening since 2011 when I started watching the charts daily.

When I started writing about this in about 2012 most people ridiculed me for suggesting that this was NOT a fair playing field and that at some point the price of gold- and other assets would skyrocket to adjust for the years -and maybe decades- of price suppression.

If these actions had not taken place, it is possible that gold would be over $25,000.00 per ounce or more. This is just based upon the dollars conjured up from nowhere. Keep in mind that Japan got a head start on “printing” their currency. Currently, it costs 474,370 Yen to buy ONE OUNCE of gold.

moreWeekly Article 04/24/2025 - ADV Happy At The Top

Mike Savage

It appears to me that we are in the early innings of what appears to be the END of our current economic system. If it were not for the threat of CBDCs becoming the next economic system I would be far more comfortable with some major changes.

Personally, I would like to see a constitutional money (hard asset) currency that would change our system from a debt-based system to an asset-based system. I actually thought that the president could have been on that path early on, but I am disappointed to say that I believe we are being flung headlong into the CBDC system.

As happy as I was when our new president closed the border and ended men beating up women in sports, I have been greatly disappointed with the economic “policy” if you can call it that.

It appears to me that all that is being done is being done to enrich those at the top and the rest of us are being left behind. Some of the reasons …

· Tariffs. We are being told that we will get “rich” with tariffs. How can that happen when foreign governments do not pay the increased costs- WE DO! This protects our large corporations from foreign competition but stifles competition and leads to higher prices. A perfect example would be the BYD electric car manufactured in China which is superior to any electric car in the USA. If there were no tariffs the car could be had for around $30,000.00. They have recently announced that the new models can recharge in 5 MINUTES. Since we have 145% tariffs, we would have to pay almost $75,000.00 for that car. This protects our auto industry but winds up giving us less choices and higher prices.

moreWeekly Article 04/16/2025 - ADV Golden Message

Mike Savage

As I have said many times there is a great effort to keep the price of gold and silver not only contained but greatly suppressed. There are many reasons but the most important one at this time is to keep many unaware of just how fragile our US dollar and economy actually are.

In the last 60 days gold has risen from $2900.00 to $3300.00. There is barely any mention of this in the mainstream media. I have also noticed that there is hardly any mention of the ongoing war in the Middle East that we are involved in. How much is that costing in new debt and lives?

All of the supposed reporting seems to be aligned to keep our eyes off of what is actually happening that will likely affect us all in one way or another and keep us worrying about meaningless nonsense that will have virtually no effect on us.

While our minds are kept far away from reality gold is giving us some ominous signs. Historically, gold rises when there is economic or geopolitical instability. We now have both.

The fact that gold has blasted higher is even more interesting when I look at the charts and notice that there are still multiple attempts daily- sometimes as many as 9 or 10 to keep the price contained. This is done by selling paper gold into the “market” and having the algorithms notice and compound the selling. For years, this scheme worked. Today, because of our economic problems and geopolitical instability the game appears to be running out of steam.

moreUpdate 04/11/2025 - ADV Short Squeeze

Mike Savage

As I was writing my weekly article yesterday the “markets” were getting hammered. By the time I got the approval to send it out the “markets” had the third largest percentage rally in history. I knew that in the short run I could look like a fool but since the “markets” are still grossly overvalued the PRICE would still have to adjust to the corresponding VALUE- or lack of it.

How did I know this? The two biggest percentage rallies in history took place in … 2008!

This is classic Bear market action.

Did the VALUE of the “markets” just magically increase by trillions of dollars in a few seconds? Did they magically lose most of it back the next day? The answer is NO.

The most likely scenario is that the blast-off on Wednesday was nothing more than a short squeeze as the “markets” started flying higher on the tariff delay news. Gregory Mannarino, who has friends on Wall Street, has stated that news of the tariff delays was leaked prior to the announcement and there were some suspicious large trades. No surprise.

The reason that the price action is so violent is that if you are short a stock that means that you have sold the stock and are hoping to buy it back at a lower price. As the price rises the losses you could incur are limitless. If it keeps going higher you could be wiped out. The more leverage- the more likely. This leads to rational people Buying to cover and close the short position out and then a cascade of more buying takes place, and the result is what it looked like yesterday.

moreWeekly Article 04/10/2025 - ADV Transition

Mike Savage

Many people look at the stock “markets” and assume it is giving us a message about how the actual economy is doing. In the past this was a coherent thought. Today, it is a HUGE mistake to think that there is any correlation between the economy and the “markets.”

As I say this, I believe that the “markets” are on their way to once again reflecting what is actually happening in the economy.

I have said many times that hundreds of trillions of currency units have been conjured up and spent to keep bond rates low, give banks an illusion of solvency, and to prop up asset (mainly stocks, bonds, and real estate) prices. This has masked the fact that our economy has been imploding at a rising rate since at least 2008. What would our GDP actually be if we did not count DEBT as GROWTH?

Most people have been conditioned to believe that every time there is a pullback in the “market” the Fed will ride to the rescue and the “markets” will resume their upward trajectory.

It appears at this time that the Fed will have a challenging time justifying lowering rates with inflation set to skyrocket because of the rest of the world SELLING our bonds and dollars and the tariff war that is taking place. The US dollar, when markets are falling usually gets stronger against other currencies as it is viewed as the safe-haven asset. Today, even with massive stock selling the dollar is continuing to fall. This is a critical thing to understand. Selling stocks and bonds means converting those assets to cash and SHOULD BE supporting the dollar. The selling pressure from around the world is not only compensating for the selling but is actually overwhelming it and pushing the dollar lower against perceived weaker currencies.

moreWeekly Article 04/04/2025 - ADV Paradigm Shift

Mike Savage

I am more convinced than ever that we are nearing a point where all that we have been anticipating for quite some time now is starting to play out. It appears to me that massive amounts of cash are being deployed to prop up bond “markets” and, in turn prop up stocks and real estate also.

In addition, even though gold has risen substantially there is plenty of proof in the daily charts that show the “off the charts” attempt to keep the price of gold capped. Many days there are dozens of smackdowns that cap the price. Even with all of the intervention the price of gold has risen 20% YTD. All of the tricks that worked in the past appear to be being undermined by the physical demand for the metals.

In addition, even with all of the effort going in to kicking the asset bubble even further down the road the stock “markets” appear to be in a managed implosion state which in reality is far superior to an outright crash. Markets do not like uncertainty and uncertainty abounds!

As far as housing goes, I really do not care if rates go up or down the prices have to fall. Why? Because regular people holding regular jobs cannot afford the prices where they are today. In addition, the proposed “solution” is lower interest rates. Keep in mind if interest rates are lowered the cost of EVERYTHING will rise making home affordability WORSE- not better. It is not just the price of the home that makes ownership unaffordable but rising costs for taxes, food, electricity, gas, insurance, maintenance, etc.

moreWeekly Article 03/27/2025 - ADV Buy Low Sell High

Mike Savage

In an average day I probably spend a good 3-4 hours doing research on many things that are mainly in topics that are directly tied to investing. I also like hearing from experts in various fields like global politics, Wars, and rumors of wars, pending legislation and anything that may have an adverse or positive impact on any investments that we hold.

In this article I am going to try and put a few ideas together from respected sources that paint an extremely bullish- in my opinion- picture not only for gold and silver but also for the companies that mine them.

It is my opinion that EVERYONE should have some exposure to the metals and possibly the miners. There are many reasons but many times the metals, in particular, have a low correlation to traditional assets like stocks and bonds. In addition, gold has been the #1 performing asset class in this century. (Bitcoin not included).

I was watching a Zoom call with Sprott- and in particular with John Hathaway- a well-known gold stock investor and fund manager. We are both on the same page in that even though the gold mining stocks have moved substantially higher they are still undervalued and grossly undervalued vs the S&P 500. He provided a chart by Bloomberg that showed that gold miners vs. S&P:

moreWeekly Article 03/20/2025 - ADV Get Ready

Mike Savage

George Carlin once said of our political system that it is one big club, and you aren’t in it.

This could not be more evident than in places like Europe, where without any say from the populace they are looking to roll out the European Digital Currency in October. Poll after poll shows that the regular people like you and me are fine with the options that we have now and that they are working well.

Of course, this new version of “money” will allow total control of how the “money” is used and will allow those “in charge” to monitor all of your spending. This is nothing but an attempt to force behaviors by using economic force.

While many who read my articles are well aware of the pitfalls of this new system of total control, I came across another bit of information that got me thinking even deeper than I had been.

I find it interesting that just a few weeks ago Christine Lagarde came out with the statement of a digital Euro in October of 2025. Right around the same time Ursula von der Leyen announced the Savings and Investments Union.

What could be the problem with a Savings and Investment Union? A tweet by Ms. Von der Leyen lays out the EXACT problem. They are aiming to redirect “unused savings” from CITIZENS to finance military growth and bolster Europe’s defense industry. “We’ll turn private savings into much needed investment.”

moreUpdate 03/14/2025 - ADV CBDCs: Control and Freedom at Stake

Mike Savage

In my earlier article I was meaning to bring out the fact that Christine Lagarde (Head of the European Central Bank) has made a statement that the EU will have a central bank digital currency by October 2025.